New Guidance from the US Treasury Opens Door to High Deductible Exemptions for Diabetes Care

On July 17, the U.S. Treasury issued new guidance which aims to make accessing medications for chronic conditions easier under some insurance plans. The guidance is specific to people enrolled in High Deductible Health Plans (HDHP) that include Health Savings Accounts (HSA).

HSAs allow people to put aside money pre-tax to be spent on certain medical expenses, and the accounts can be rolled over from year to year. Previously the federal tax code specifically barred these plans from covering drugs and services for common chronic conditions until enrollees met their deductibles. This change will allow insurers to cover certain treatments before the deductibles are met.

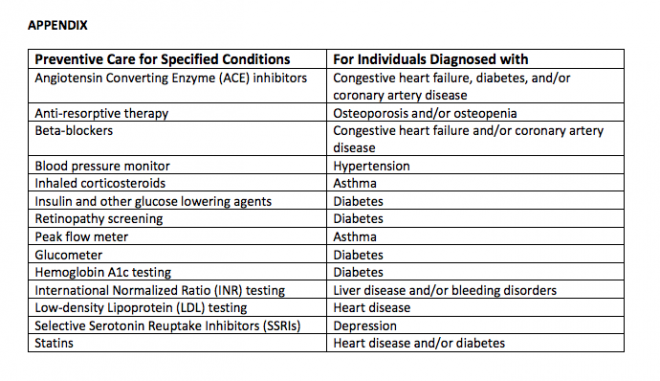

Preventative treatments are typically exempted from the deductible phase of an HDHP, and this new guidance expands the list of what can count as a preventative service to include drugs and tests relevant to the management of chronic conditions, including insulin for people living with diabetes.

Insurance providers as well as advocacy groups have been pushing for these changes; managing chronic health conditions before they become exacerbated and indeed—more costly—can be viewed as a win-win for both patient and insurer. For people with diabetes, uninterrupted access to insulin is both life-sustaining and cost saving.

The reasoning for the guidance is explained as follows: “Cost barriers for care have resulted in some individuals who are diagnosed with certain chronic conditions failing to seek or utilize effective and necessary care that would prevent exacerbation of the chronic condition. Failure to address these chronic conditions has been demonstrated to lead to consequences, such as amputation, blindness, heart attacks and strokes that require considerably more extensive medical intervention.”

The guidance does not require any formal rule-making process, and can go into effect for insurance plans starting in 2020. There are some conditions on what treatments can be approved under this new guidance, listed as follows:

- The service or item is low-cost;

- There is medical evidence supporting high cost efficiency (a large expected impact) of preventing exacerbation of the chronic condition or the development of a secondary condition; and

- There is a strong likelihood, documented by clinical evidence, that with respect to the class of individuals prescribed the item or service, the specific service or use of the item will prevent the exacerbation of the chronic condition or the development of a secondary condition that requires significantly higher cost treatments.

The guidance is part of a broader push by the Trump administration to fix prescription drug pricing, and was in direct response to last month’s Executive Order “Improving Price and Quality Transparency in American Healthcare To Put Patients First”. The EO directly called on The Secretary of the Treasury to “issue guidance to expand the ability of patients to select high-deductible health plans that can be used alongside a health savings account, and that cover low-cost preventive care, before the deductible, for medical care that helps maintain health status for individuals with chronic conditions.”

If health insurance plans decide to take advantage of this new rule, out of pocket costs could be substantially cut for millions of Americans currently enrolled in the impacted insurance plans. For people with type 1 diabetes specifically, high deductible phases can mean a sudden inability to afford the high list price of insulin, which is often over $1000 per month. Exempting insulin from the deductible would ensure more seamless access to the life-sustaining drug.