Health Insurance Guide for T1D

Choosing a plan

Choosing an insurance plan for type 1 diabetes involves asking the right questions. First thing’s first: timing is extremely important when dealing with insurance. If you have health insurance through your employer, ask HR about open enrollment dates (typically the last few months of the year). Medicare open enrollment is October 15 through December 7 yearly and for individual insurance (not through your employer), open enrollment is November 1 through December 31, though this varies state to state. For 2022 enrollment, Healthcare.gov is open through January 15.

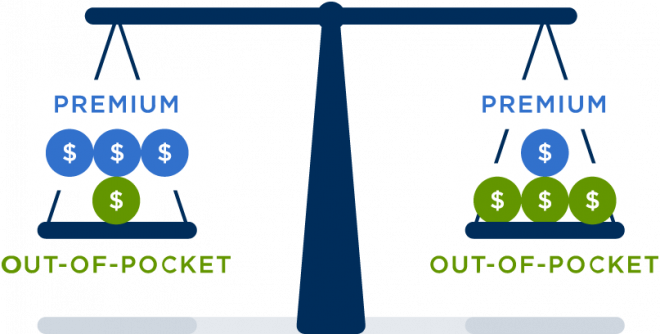

Understanding costs is also crucial and those associated with insurance plans usually have to do with two things: 1) your monthly premium and 2) out-of-pocket costs (like co-pays, co-insurance and deductibles). When choosing a health plan, ask yourself which of the following applies more: Would you rather pay more of a set amount each month (premium) and less when you see the doctor (co-pays, co-insurance or deductible)? OR Would you prefer to pay less of a set amount each month and more when you need to see the doctor? Understanding the difference between in and out of network (you’ll pay more out of network), if a health savings account or flexible spending account is for you (these might save you tax dollars), and if you can easily submit an appeal if necessary are also important factors when considering choosing a plan. Get the comprehensive guide to choosing a plan here.

Help with costs

A large chunk of healthcare costs for those with diabetes comes from a need for prescriptions. Through state and nonprofit programs, assistance programs from pharmaceutical companies and generic alternatives, there are methods to cutting these costs. For assistance with insulin costs, input your information here to receive your insulin access Action Plan. Additional nonprofit patient assistance programs include FamilyWize, Partnership for Prescription Assistance, NeedyMeds, RxAssist, RxHope and RxOutreach.

Denials and appeals

A denial is when your insurance company notifies you that it will not cover the cost of a treatment or medication. While frustrating, it’s important to know that you have the right to appeal the decision. An appeal is an official ask to your insurance company to reconsider its denial. More than 50 percent of appeals are successful, so it’s an important avenue (and your legal right!) to consider.

There are a few things to be mindful of when filing an appeal. First: know all necessary details (plan and member numbers and DOB) and keep track of dates, times, and who you speak with. Second: be mindful of timing, as there are limits to how long you may make an appeal after receiving a denial. Third: work with your doctor and their staff to get the best results, all necessary paperwork and a letter of support. Check out a more in-depth explanation of denials and appeals here.

Prior authorizations

A prior authorization (PA) is a requirement from your health insurance company that your doctor obtain approval from your plan before it will cover the costs of a specific medicine, medical device or procedure. Check with your insurance company to get the specific protocol for their authorization process, but the main steps in the process are pretty standard. The common five ones are as follows : 1) check your plan’s policy and formulary to see if PAs are required, 2) locate the process for submitting and obtain necessary forms, 3) work with your doctor, 4) ensure the PA is submitted according to guidelines, and 5) the PA will then be approved of denied, but you can appeal if the latter is the case.

There are a few helpful tips for successfully obtaining a prior authorization. It’s important to work closely with your doctor’s office, knowing which individual handles PAs and heeding their advice on how to be successful. Be extremely thorough, making sure the PA form is completely filled out and entirely accurate, and keeping track of dates, times and who you speak to at your insurance company regarding the PA. Being mindful of timing by starting the process earlier rather than later and knowing all key dates is also a way to help ensure success. A robust explanation of PAs can be found here.

Applying for an exception

Not all medications, devices and services are covered by insurance plans even though they might be necessary. In these cases, patients can choose to make exception requests. Exception requests are written requests to your insurance company to cover a medication, device or service that a doctor has advised as necessary for treatment. Exceptions for type 1 diabetes might include those requested for types of insulin, pumps, continuous glucose monitors (CGMs), or other treatment. When your doctor recommends a new treatment, check your plan details accordingly or call the number of the back of your insurance card to see if it is covered.

To submit an exception request, 1) check your plan’s information or formulary to see if treatments aren’t covered, 2) locate the process to submit requests for your plan, 3) contact your doctor to develop and submit it, 4) ensure you followed all guidelines and make a copy for your records, and 5) the request will then be approved or denied, but you can appeal if the latter is the case. There are a few helpful tips for successfully obtaining an exception request. It’s important to work closely with your doctor’s office, knowing which individual handles these requests and heeding their advice on how to be successful. Being mindful of timing and asking that the request be approved for the full extent of your time as a plan member is a good idea. A more in-depth guide to exception requests can be found here.

Switching treatments

Needing to switch treatments can occur, and it’s important to take the appropriate steps once you and your doctor have determined that this is best for you. Reviewing your policy should be your first course of action to see whether a new treatment is covered. Call your HR department or health insurance company if coverage is unclear. If the new treatment is covered, you should make sure to understand how much it will cost by reviewing your plan’s formulary or calling a representative at your insurance company. If the new treatment is on a different prescription tier, your out-of-pocket costs will increase. Make sure to determine whether this new treatment will require a prior authorization.

If the new treatment isn’t covered, you should determine the pros and cons of staying on your current treatment to see if it’s truly worth switching. A good idea might also be to see if any alternatives are covered. Gauge the difference in cost and know that if the treatment is deemed medically necessary by your doctor, you can request an exception. Get more detailed information on switching treatments here.

Common issues with insulin, CGMs + pumps

When it comes to your health insurance, common issues might arise and it’s important to be aware of any and all of them. Insulin often involves patients seeing tiering issues because certain brands and types of insulin may be covered or may not, impacting out-of-pocket costs. Consulting your plan’s formulary (list of covered medicines) is helpful in this case. Making sure your prescription gives you the amount of insulin you need is also a must, so be sure you and your doctor are aligned. Test strips can also give patients trouble coverage-wise, as some health insurance plans limit the number of test strips you can obtain over a specific period. Check your plan’s formulary and specific policy related to testing supplies to find out necessary details.

Coverage for devices like insulin pumps and CGMs can trouble patients from time to time, as there needs to be alignment with plan criteria and a prior authorization might be required to obtain a pump or CGM. Pump and CGM supplies also vary in cost and coverage depending on your plan. When encountering pump and CGM issues, consulting the company that makes your device may be helpful for navigating insurance difficulties. Get a more in-depth understanding of common insulin, device and supply issues here.

Working with employers

If you have health insurance coverage through your employer, your HR department can be a useful resource. Firstly, they can function as a health insurance specialist when choosing your plan and might be able to help you determine how to get your T1D-specific needs met by the right plan, and how plans might affect your care or finances. Secondly, they can be a health insurance advocate for future plan decisions. They can offer support as you begin to use services under your coverage, especially if you find your plan isn’t quite working for you. Lastly, they might play the role of a health insurance intermediary if there are unexpected problems. HR can be there when you encounter challenges and might be willing to gather detail as your insurance claim advocate. For a few helpful scenarios in which your HR department might prove helpful, head here.

Medicare

Medicare is a federally run health insurance program for people age 65 and older and people with disabilities. You can visit www.medicare.gov to get more information. Medicare consists of four parts:

- Part A covers primarily inpatient hospital and skilled nursing facility services.

- Part B covers primarily physician and outpatient hospital services, as well as equipment like insulin pumps, test strips and some CGMs.

- Part C is offered by private insurance companies and cover the same benefits as Part A and B, plus many offer drug coverage, similar to Part D

- Part D, which covers prescription drugs that you typically obtain at a pharmacy and may also cover disposable insulin “patch pumps.” Look out for plans that are a part of the Medicare Part D Senior Savings Program, which caps the monthly cost of insulin taken via pens or syringes at $35 on select plans.

Parts B and D are most relevant to those with T1D and day-to-day management. Understanding your options for Medicare is important, and the two basic options are to 1) enroll in Original Medicare Parts A and B, or 2) enroll in a Medicare Advantage (MA) plan. The authoritative place for evaluating available options for Medicare coverage is the Medicare Plan Finder.

Things like test strips, CGMs and pumps can all be covered by parts of Medicare, but this varies depending on factors like method of insulin delivery and device choice. For instance, insulin for injections and a disposable patch pump (Omnipod) are covered under Part D, but covered under Part B if used in a tubed pump. Test strips are covered by Medicare Part B. Medicare will cover a CGM if it has been approved for use in diabetes by the FDA. Tubed insulin pumps are also covered under Medicare, and Medicare has announced that Part D plans may choose to cover patch pumps. Medicare does not currently extend to hybrid closed-loop systems. Find a comprehensive explanation of Medicare and how it relates to type 1 diabetes (T1D) here.

Insurance Terms

A claim is a request that you or your doctor submit to your health insurance when you receive care/services. Your deductible is the amount you are required to pay for medical services until your health plan begins to pay. A formulary is a list of prescription medications covered by your insurance plan, and a premium is the amount you pay monthly to keep your insurance plan.

These are just the tip of the iceberg when it comes to health insurance terms and many prove unfamiliar to most people. Having a glossary is helpful for an easier understanding of the overall healthcare system and what is required of you. For a full list of helpful terms, head here.