Is Pharma Breaking the Law?

Editor’s Notes: The lawsuit filed in Massachusetts has been withdrawn and refiled in New Jersey.

People who take insulin require consistently affordable and predictable sources of insulin at all times. If you or a loved one are struggling to afford or access insulin, you can build custom plans based on your personal circumstances through our tool, GetInsulin.org.

On Monday, January 30, 2017, a lawsuit was filed in Massachusetts by Hagens Berman against the largest producers of insulin—Sanofi, Novo Nordisk and Eli Lilly. The class action complaint states that the pharma companies are artificially inflating insulin prices to secure favor from pharmacy benefit managers (PBMs) who decide how a drug will be covered on a list of approved drugs for health insurers.

According to the New York Times, “Insurers do not pay the list prices that the drug makers set. Instead, the pharmacy benefit managers negotiate a rebate that is returned to them. The benefit managers, in turn, take a slice of that rebate for themselves.”

The idea is that the bigger the “spread” between the sticker price and the actual price, the bigger the rebate and kick back to the PBMs. “Basically, the PBMs are getting a piece of the difference between the wholesale and list price to place one of these drugs on the formulary,” says Steve Berman, lead council in the lawsuit.

It is because of this “scheme” as the suit says, that type 1 and type 2 diabetes patients are forced to pay exorbitant prices for life-saving insulin. For comparison, the exact same insulin is six times more expensive in the US than it is in Europe (The New York Times).

The lawsuit cites that in the last five years alone, all three of the pharma companies have raised their public insulin prices by more than 150 percent.

The PBMs or “bulk drug distributors” aren’t the target of the lawsuit though. Berman explains why: “It’s the drug companies that are publishing the list price. They’re the principle wrong-doers.”

In response to the recent class-action, Sanofi said, “We strongly believe these allegations have no merit.” Novo Nordisk also disagreed with the allegations but released this statement to Beyond Type 1: “We are aware of the complaint and its characterization of the pharmaceutical supply chain.” Eli Lilly replied, saying, “We conduct business in a manner that ensures compliance with all applicable laws, and we adhere to the highest ethical standards.”

It’s obvious that the price of insulin has skyrocketed, but the real question is what laws have been broken, if any, in the process by big pharma?

Berman, proposes three, specifically. He sites the Racketeer Influenced and Corrupt Organizations Act (RICO), antitrust laws and Unfair and Deceptive Acts and Practices (UDAP).

“We have regulations against this,” says Berman. “We have laws that say the defendants can’t do what they are doing and private attorneys like myself, along with state general attorneys can enforce those laws.”

Passed in 1970, RICO is a federal law that allows prosecution and penalties for racketeer activity that may include “mail and wire fraud,” which is defined as “any fraudulent scheme to intentionally deprive another of property or honest services via mail or wire communication.” (Wikipedia). Mail and wire fraud has been a federal crime in the US since 1872.

Setting “an artificially-inflated price” as Berman says, would fall under this type of fraud.

“Antitrust laws,” says Berman, “prevent companies from getting together to fix prices.” Berman has experience with antitrust litigation, having won a class-action lawsuit against Apple Inc. and five of the nation’s top publishers in 2016 for illegally fixing prices of e-books.

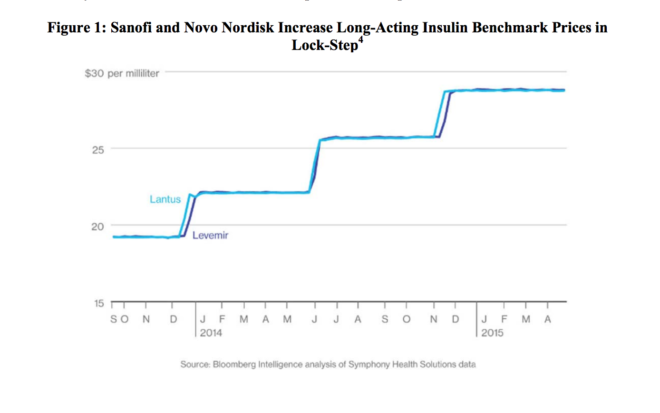

While it may be difficult to prove that the companies colluded to raise prices collectively, it is impossible to deny that the three drug makers have raised their prices “in step.”

The price escalation has been called an arms race, as the drug companies compete in offering the highest benchmark price and with that the highest “fat” to offer PBMs. This has been done in tandem.

There is also the Unfair and Deceptive Acts and Practices (UDAP). These consumer protection acts vary in each state but generally prevent consumer deception by ensuring a fair marketplace.

Rising insulin prices are not just hurting patients financially but also having an immediate and detrimental effect on patients’ health. When patients cannot afford the insulin prescribed by their doctors, people with diabetes have reported skipping dosing, injecting expired or damaged insulin and even starving themselves to lower their insulin requirement.

Insulin restriction has serious health effects for people with type 1 and 2 diabetes, causing elevated blood sugars which in turn cause “serious complications such as kidney failure, heart disease, blindness, infection and amputations” (suit). For people with type 1 diabetes in particular, a lack of insulin is a death sentence. Without insulin, someone with type 1 could die in days or weeks. The ability to afford insulin is a matter of survival.

“If people [and companies] conducted themselves honorably,” says Berman, “we wouldn’t have this problem.”

The law firm seeks to represents the millions affected by this and aims to stop the practice of payments made off of phony list prices.

Read The Million of Us by Eddy Murphy.