At What Cost? The Impact of Diabetes on Your Budget, Part 2

Written by: Lala Jackson

6 minute read

July 6, 2020

Editor’s Notes:

- People who take insulin require consistently affordable and predictable sources of insulin at all times. If you or a loved one are struggling to afford or access insulin, you can build custom plans based on your personal circumstances through our tool, GetInsulin.org.

- For privacy purposes, all people included in our budget series will be anonymous. All budget numbers are self-reported.

- For a simple comparison to other experiences in our At What Cost? series, we’ve converted our subject’s CAD $ into USD $ based on the conversion rate of June 29, 2020.

In this new series, we’re digging into the impact that living with type 1 diabetes has on your money.

We know this looks drastically different from person to person, depending on your health insurance coverage, your earnings, your ability to qualify for patient assistance programs and more. Then there’s the rest of life—student loans, childcare, transit costs, groceries, rent and more.

We also know there are things that can’t be quantified—the amount of time and energy anyone impacted by type 1 diabetes (T1D) has to spend navigating the healthcare system, health insurance companies, the amount of time and energy it takes to manage T1D and more.

So we’re asking people who are living with type 1 diabetes to share what their budget looks like. In April, we shared one month in Pembroke, New Hampshire on a $44,000 annual salary.

Now, one month in London, Ontario on a $17,537 USD salary, with type 1 diabetes.

Overview

Age: 26, diagnosed with type 1 diabetes at 10

Location: London, Ontario, Canada

Occupation: Dietary Aide in a Hospital

Annual Income: $17,537 USD ($16,806 from employer, $731 from speakers fees at diabetes events and selling clothing, home décor and furniture)

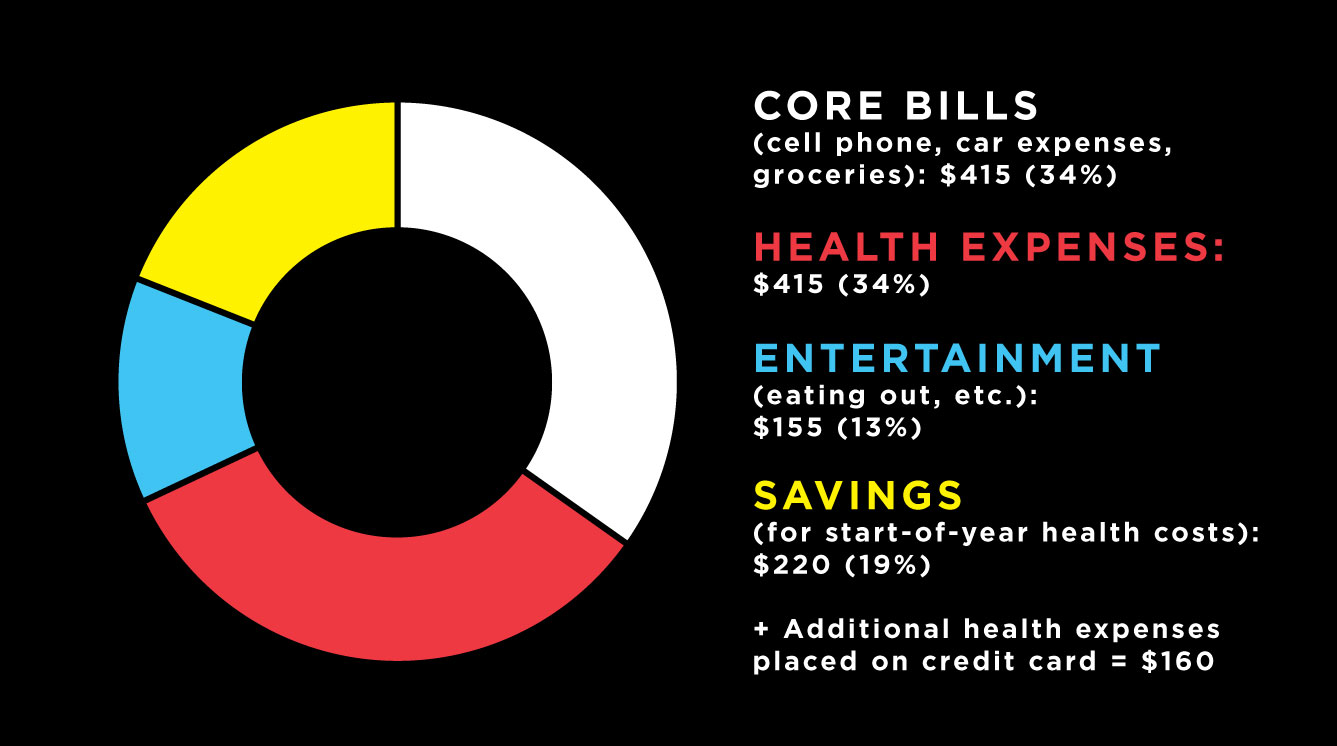

Monthly Budget

Core Expenses:

Take home pay, after taxes: $1,205 USD

Rent: $0 (able to live with parents)

Cell phone: $55

Student loans: $0 (was able to pay off)

Car, incl. Payment, insurance, gas, etc.: $250

Groceries: $150

Health Expenses:

Health Insurance Plan: Sun Life Personal Health Insurance, Coverage Policy C

- Durable Medical Equipment coverage: None through health insurance. The province of Ontario offers the Assistive Devices Program, which covers $145/month of insulin pump supplies.

- Prescription drug coverage: Insurance covers 80 percent of cost of medications, up to a yearly maximum of $1417. After the maximum is hit, individual is fully responsible.

Health Insurance Premium (portion paid by individual): $123

Insulin: $7

Blood Sugar Monitoring: $220 for Dexcom supplies (goes mostly on credit card)

Insulin pump supplies: $65 for Omnipod (this is the out of pocket cost; majority of monthly cost is paid by Ontario’s Assistive Devices Program)

Additional Prescriptions and Doctor’s Visits: $30

Wellness & exercise, incl. gym membership: $130

Disposable Income Expenses:

Self care & Entertainment: $15

Eating out + coffee: $70

Clothing: $70

Savings Contributions:

Registered Disability Savings Plan (RDSP): $145

Mutual fund: $75

The Backstory

Health expenses

Paying for healthcare in Canada is harder than I thought it was going to be—if you have a pre-existing condition, a lot of insurance companies will not cover you. There are provincial programs, but they do not cover all expenses, and private coverage—if you can get it—covers things to an extent. I was only covered because I was coming right off of being covered by my parents, but my options were still limited.

In my initial coverage, my prescription coverage was not enough for me. They would cover up to $2,000 worth of medications at 80 percent coverage (I paid the other 20 percent of cost until I hit $2,000), but after that I was out of pocket. And insulin is not the only medication I need to take, so I got really nervous.

Last year, I hit that $2,000 cap in November, so I had to pay in full for my other medications at the end of the year. Luckily I had just started on my Dexcom continuous glucose monitor (CGM) so I no longer had to pay for test strips, but Dexcom itself was out of pocket too. For both Dexcom and my Omnipod insulin pump, I put the expenses on a credit card and then paid that off slowly.

That’s of course despite coverage for the majority of medications being quite good. My insurance covers quite a bit and my province provides funding for my insulin pump. But the CGM coverage is awful. It’s crazy to me that with all the evidence and proof of how much CGMs improve quality of life, prevents severe lows and severe highs, they’re not covered. It should be obvious that something like that that should be covered.

I had known I wanted a Dexcom CGM for a while—the participants at the diabetes summer camp I’ve worked at for the past two years let me see it in action—but I couldn’t afford to pay for it for a long time. I was paying off school debt. But I made the decision to go for it even though it was going to cut me really close with the money I have to spend. The trade off was knowing I wouldn’t be able to stop living at home.

Forced trade-offs

With my medical expenses, there’s no possible way for me to not live with my parents. I’m 26 and I want to be independent, but a few years ago, I started looking around. When I looked at the cost of everything, I knew there was no way I could afford to move out.

The greater impact

Because I need to pay for diabetes care, there are things I give up. For example, when I signed up for my health insurance, it didn’t include dental. I knew I couldn’t afford it. I don’t have dental coverage so I haven’t had a dentist appointment in three years, which is of course not ideal for someone with diabetes since we are more likely to have dental and gum issues. It’s something I’ve had to trade off so I can get my core diabetes needs. I think I’m okay, but it’s scary.

What do you wish people understood?

So much of what we need to live, just to survive, just isn’t covered. Especially in the states, the cost of your insulin is something I can’t believe. You will literally die without insulin, yet the cost is so high.

Paying rent or paying for your medication shouldn’t be a choice anyone has to make. Even having to choose between paying for medication or paying for things like self-care things or a gym membership. Those are important.

Read Part I and Part III in this series.

Editor’s Note: People who take insulin require consistently affordable and predictable sources of insulin at all times. If you or a loved one are struggling to afford or access insulin, click here.

Author

Lala Jackson

Lala is a communications strategist who has lived with type 1 diabetes since 1997. She worked across med-tech, business incubation, library tech and wellness before landing in the type 1 diabetes (T1D) non-profit space in 2016. A bit of a nomad, she grew up primarily bouncing between Hawaii and Washington state and graduated from the University of Miami. You can usually find her reading, preferably on a beach.

Related Resources

Danica Collins not only prepared for one of the most challenging physical events of her...

Read more

Beyond Type 1 is spotlighting inspiring athletes with type 1 diabetes as they prepare for...

Read more

On November 3, 2024, Taylor Rindfleisch of Chicago laced up her running shoes for the...

Read more