At What Cost? The Impact of Diabetes on Your Budget, Part 3

Editor’s Notes:

- People who take insulin require consistently affordable and predictable sources of insulin at all times. If you or a loved one are struggling to afford or access insulin, you can build custom plans based on your personal circumstances through our tool, GetInsulin.org.

- For privacy purposes, all people included in our budget series will be anonymous. All budget numbers are self-reported.

In the third installment of our diabetes budget series, we’re digging into the impact that living with type 1 diabetes has on your money.

We know this looks drastically different from person to person, depending on your health insurance coverage, your earnings, your ability to qualify for patient assistance programs and more. Then there’s the rest of life—student loans, childcare, transit costs, groceries, rent and more.

We also know there are things that can’t be quantified—the amount of time and energy anyone impacted by type 1 diabetes (T1D) has to spend navigating the healthcare system, health insurance companies, the amount of time and energy it takes to manage T1D and more.

So we’re asking people who are living with type 1 diabetes to share what their budget looks like. In part 1, we shared one month in Pembroke, New Hampshire on a $44,000 annual salary. In part 2, we shared one month in London, Ontario, Canada on a $17,537 USD annual salary.

Now, one month in Washington, DC on a $67,000 annual salary, with type 1 diabetes.

Overview

Age: 27

Location: Washington, DC

Occupation: Senior Analyst, International Economic Development Consulting

Annual Income: $67,000

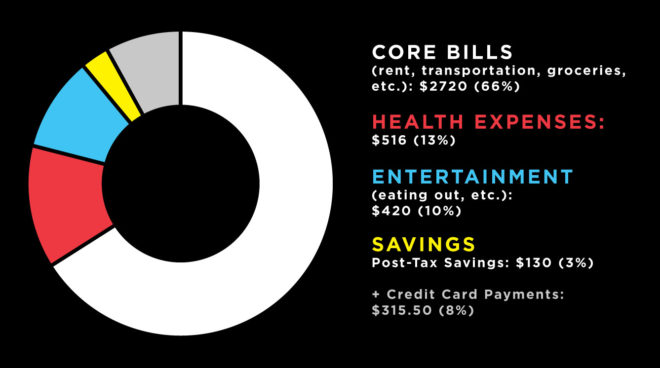

Monthly Budget

Core Expenses:

Core Expenses:

Take home pay, after taxes: $4,101.50

Rent, Included Utilities + Renter’s Insurance: $1,673

Internet: $59

Student loans: $288 + $300 (into a mutual fund for future student loan lump payment)

Groceries: $400

Our subject’s $100 monthly DC transit pass comes out of their pre-tax income.

Health Expenses:

Health Insurance Plan: United Healthcare PPO

- Deductible (Individual): $250/$750 (in-network/out-of-network)

- Our subject’s monthly health insurance premium of $177.32 and dental insurance premium of $22 comes out of their pre-tax income.

Out of Network Endocrinologist via Concierge Medicine: $137.50

Insulin: $10

Insulin Pump Supplies: $125 every 3 months for Medtronic supplies

Blood Sugar Monitoring: $35 per month for test strips, $125 every 3 months for CGM supplies

Additional Prescriptions: $35

Cognitive Behavioral Therapy: $215

Disposable Income Expenses:

Self Care (salon/barber, etc): $50

Eating Out + Coffee: $250

Clothing: $50

Misc. Entertainment: $70

Savings Contribution:

401(k): 8% from pre-tax income

Short Term Savings Account: $80

Roth IRA: $50

The background story

I’m 27, which meant that last year I was kicked off of my parent’s insurance and had to start navigating my own. I’m very privileged in so many ways—when I was a kid, my parents were able to get me an insulin pump. My parents were able to pay off my medical debt. We had great insurance coverage.

Now on my own insurance plan, I still have great coverage for the most part, but my endocrinologist who I had been seeing was no longer covered, nor was my therapist. With a chronic disease like type 1 diabetes, it’s so important that we’re able to see medical providers we trust and who know our specific case, so the idea of switching around is scary, and having to do it because of insurance coverage is wrong.

Stacked medical expenses

Once I had to be on my own insurance plan, I quickly went into credit card debt. I was trying to take on the cost of living and working in DC, a very expensive city, and new healthcare costs on my own. I think if I had asked my parents for help they would have, but I was trying to do it myself. I was living in a cheaper place at the time, but I didn’t have a good handle on my spending.

I’m getting back on track now. My largest expenses outside of rent and such are my student loans, the cost of my endocrinologist and the cost of cognitive behavioral therapy. I spoke with a financial planner who focuses on people with high student loan debt. I save every month for the annual fee for my endocrinologist, who operates through a medical concierge service. I try to see my therapist at the end of the month so that the expense hits after my other monthly medical expenses. The therapist will be covered at 80 percent once I hit my out-of-network deductible.

Sometimes I feel like I should have gone a different route—find a new endocrinologist and a new therapist who are both in-network. But my endo was my fourth endo in two years, and it’s so hard to find a good one. I had seen such great progress with my endocrinologist and therapist that I didn’t want to shake anything up. I had just started a new job. I didn’t want to throw another new thing into the mix, but I find it frustrating that they don’t take my insurance. I’m so lucky to be in a position where I can afford it.

The impact of money on mental health

I had had an anxiety episode. I was sitting on a bench after crying on the DC Metro. It was a work related thing. I told myself I would treat myself to takeout and a movie at home, but then I realized I couldn’t afford it. My student loan payment was due. I was looking down such a long barrel of payments. We’re not educated on the options for student loan repayment and I knew I was in over my head.

I felt the one thing I could control was my finances. I found a financial planning company that specializes in large student loans. My parents very generously gave me part of their bonuses from work—a $5,000 gift for Christmas—which I used to help pay down the credit card debt I had accrued.

With COVID, I’ve been staying at my parents’, so have been able to save money on what I would have been spending on my own groceries and eating out. That money has gone toward credit card debt as well. When I was traveling for work, I got a per diem and got to keep anything extra that I didn’t spend, so I’d put that toward my credit card debt too.

I started using budgeting software to stay on track. It was a mental switch. It felt like the only thing I had control over. The control thing is what precipitated me having to get help from a therapist. I know I have a plan with my student loans now.

I stress about savings for the future because I know I’m going to have higher healthcare costs than the average American as I get older. Because of my student loan debt, I don’t think I’ll ever own a home. I think about whether or not I’ll be able to afford to have kids. But I try not to worry too much about that. I’m only 27. I’m quite new in my career. But it’s a lot to have to weigh.

The balance of mental and physical health

All of the health things to balance—it’s so constant. I developed PCOS (polycystic ovarian syndrome). It’s tied with insulin resistance issues. I have other hormonal stuff as well. Blood sugar is already its own thing to try to balance, and then you add in curve balls. It’s so constant. Even the constant alerts from my insulin pump and continuous glucose monitor (CGM). It never stops.

It’s important for your friends and family to understand just how much all of this is to manage. And if you can’t talk to them about it, you have to find people you can talk to about it. Having a support system is so important.

I see a cognitive behavioral therapist because I’ve always struggled with taking care of myself and burnout. High quality therapy should be available to anyone who needs it. Managing a chronic disease is behavioral. Therapy is so important for chronic disease management.

Read Part I and Part II in this series.

Editor’s Note: If you or a loved one are struggling to afford or access insulin, click here.