Have Diabetes and Enrolling in Medicare? Start Here

Enrolling in Medicare and need help? shiphelp.org is a free, available-to-anyone service that offers localized, expert help in choosing all of the different aspects of a Medicare plan—including programs that may lower your out-of-pocket costs—that will be right for you. Need help accessing insulin? Head to GetInsulin.org to create a customized access plan.

Even if you are already enrolled in a Medicare healthcare plan, right now is the time to see whether there is a better, more comprehensive and less expensive plan available to you. From now through December 7, 2021 everyone currently enrolled in Medicare is eligible to switch plans—and everyone eligible but not yet enrolled can sign up—for healthcare coverage in the 2022 calendar year.

According to the Kaiser Family Foundation, last year, only about 30 percent of people enrolled in Medicare compared plans to see if they could find better coverage. “Medicare beneficiaries with traditional Medicare can compare and switch Medicare Part D stand-alone drug plans or join a Medicare Advantage plan, while enrollees in Medicare Advantage can compare and switch Medicare Advantage plans or elect coverage under traditional Medicare with or without a stand-alone drug plan. Beneficiaries have no shortage of plans to choose from: in 2021, the average Medicare beneficiaries can choose among 33 Medicare Advantage plans and 30 Part D stand-alone prescription drug plans (PDPs).”

Bottom line: if you’re not comparing plans, you could be missing out on better and/or less expensive healthcare. Below, we’ll show you how to compare.

If you are not yet enrolled in Medicare, your first step is to check whether or not you qualify. In the United States, Medicare is a federal health insurance program for people aged 65 years and older, as well as for certain younger people with disabilities (those under 65 who qualify receive disability income from Social Security or the Railroad Retirement Board, or have End-Stage Renal Disease or Lou Gehrig’s Disease (ALS)). It functions quite differently than most other types of health insurance, and it is important to be very precise about which plan you sign up for if you are living with diabetes.

In 2021, some Medicare plans started capping the out-of-pocket cost of insulin prescriptions, but not all plans offer this coverage and only certain people qualify. For this and other intricacies of Medicare, here’s what you need to know.

When to enroll in Medicare

For most people, Medicare eligibility is based on age. You can sign up during a window starting three months before the month you turn 65 and ending three months following your birthday month, or you can sign up during Medicare Open Enrollment, which is Friday, October 15, 2021 through Tuesday, December 7, 2021 for 2022 coverage.

If you are already covered under a Medicare plan, this Open Enrollment period is the only time in which you can make changes to your coverage, so it is worth reviewing your plan to see if any changes are needed.

Understanding your options for Medicare is important, and the two basic options are to 1) enroll in Original Medicare Parts A and B, or 2) enroll in a Medicare Advantage (MA) plan. The authoritative place for evaluating available options for Medicare coverage is the Medicare Plan Finder.

What do all the types of coverage mean?

Medicare consists of four parts:

- Part A covers primarily inpatient hospital and skilled nursing facility services.

- Part B covers primarily physician and outpatient hospital services, as well as equipment like insulin pumps, test strips and some continuous glucose monitors (CGMs). It also covers the insulin used via tubed insulin pumps.

- Part C is offered by private insurance companies and covers the same benefits as Part A and B, plus many offer drug coverage, similar to Part D

- Part D covers prescription drugs that you typically obtain at a pharmacy—like your insulin if taken via pens, syringes, or a tubeless insulin pump—and may also cover disposable insulin “patch pumps” (like the Omnipod). New in 2021 was the Medicare Part D Senior Savings Program, which caps the monthly cost of insulin taken via pens or syringes at $35 on select plans.

For more explanation on these and other things to consider when enrolling in Medicare as a person with diabetes, visit our partner JDRF’s guide on Medicare enrollment. This guide includes guidance on additional cost savings qualifications, Medigap plans and more.

Finding the best plan, step-by-step

You can sign up for Medicare online, via phone at 1-800-MEDICARE (1-800-633-4227), or by visiting your local Social Security office. Medicare Advantage plans are sold through private insurers.

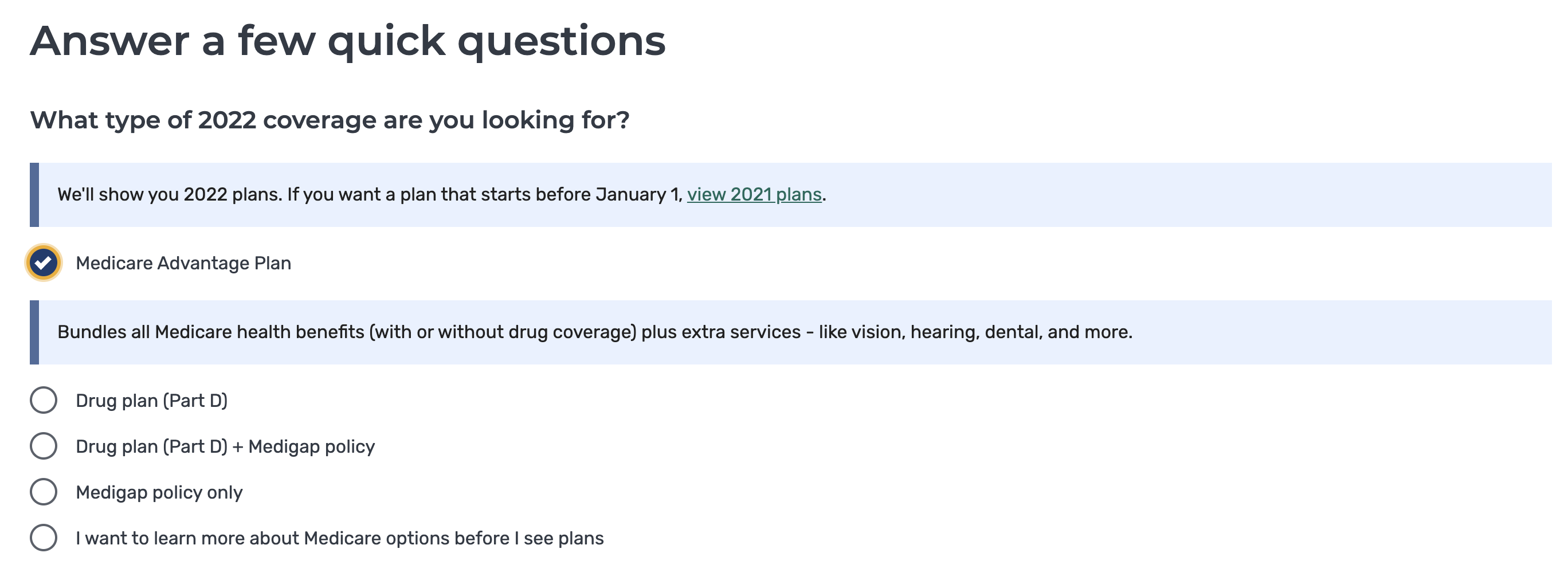

1) To review Medicare plans, use the Plan Finder. For the purposes of this walk-through, we are going to go through the process of finding an ideal Medicare Advantage plan (comprehensive Medicare coverage offered through private insurers).

2) From there, you will enter your home zip code, then press continue. Confirm your county, and answer the next question on whether or not you receive help with your costs from any of the listed programs (if you do, be sure to select it, as this may also lower your healthcare costs), then press next.

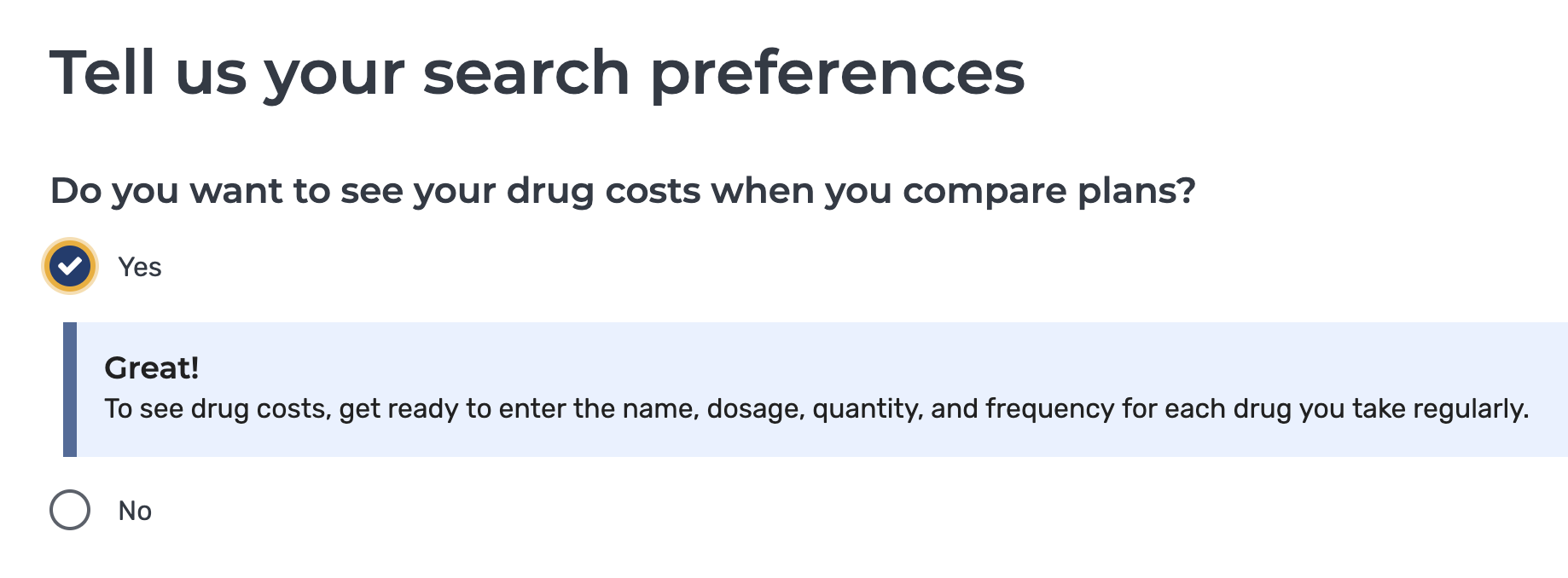

3) In the next question (shown below), be sure to select that you do want to see your drug costs when you compare plans.

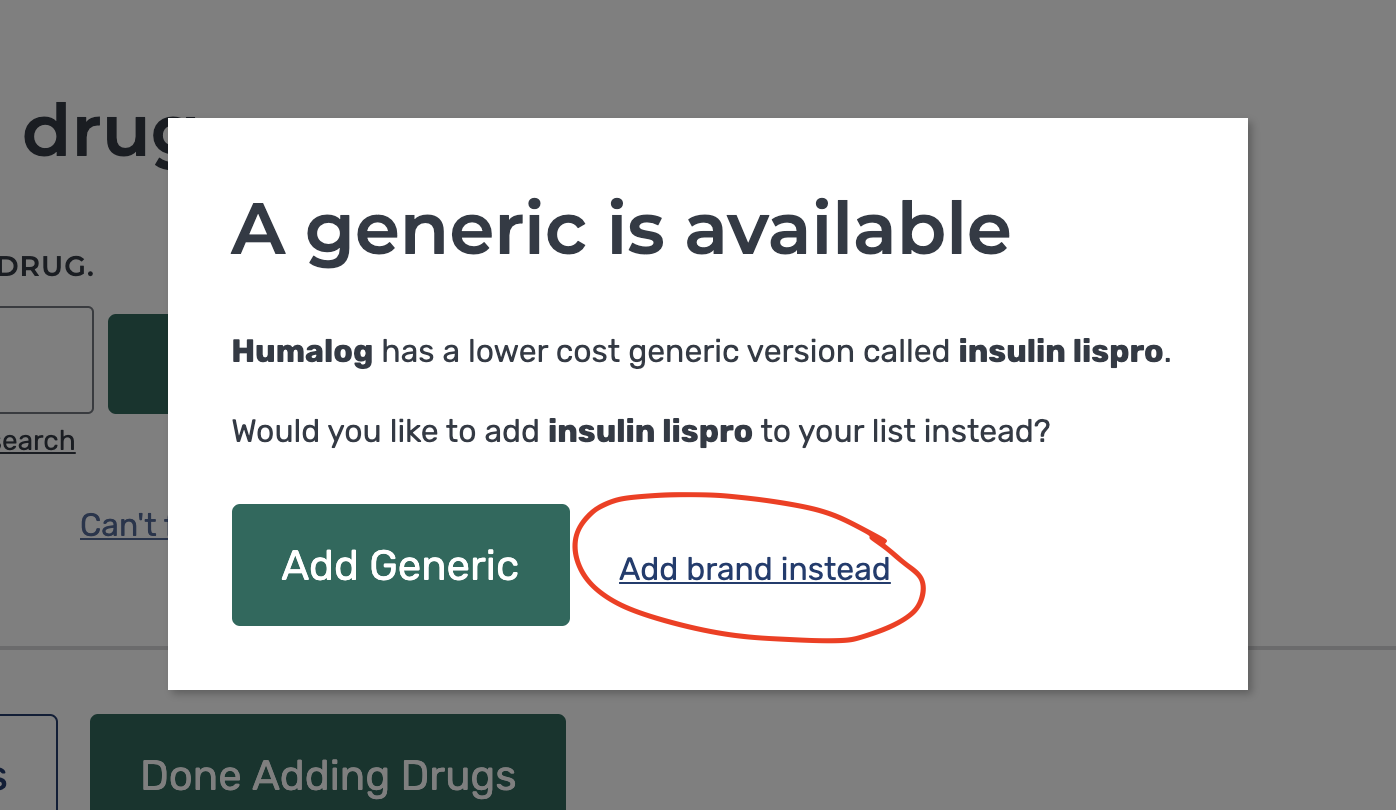

4) Next, when adding your prescription drugs, be sure to add every medication you take to get the most accurate summary of what you can expect your costs to be in 2022. The plans and cost estimations you are shown based on this answer will account not only for how much your insulin costs, but also for any and all other drugs you input.

When you enter your insulin type, be sure to select “add brand instead” (as shown below) when a pop-up window prompts you on whether you would like the generic version of your medication. This will ensure you can get the exact medication your doctor has prescribed.

For each medication, you will enter details around how much of the medication you take. Once you’re done adding medications, click the green button that says “Done Adding Drugs.”

You will then enter your pharmacy information (you can search for your pharmacy if you don’t know the exact contact details). Enter a few different companies for pharmacies and select mail-order as well, as it may offer less expensive options. Each pharmacy has its own negotiated rates for medications, so your out-of-pocket costs may change based on the pharmacy you choose.

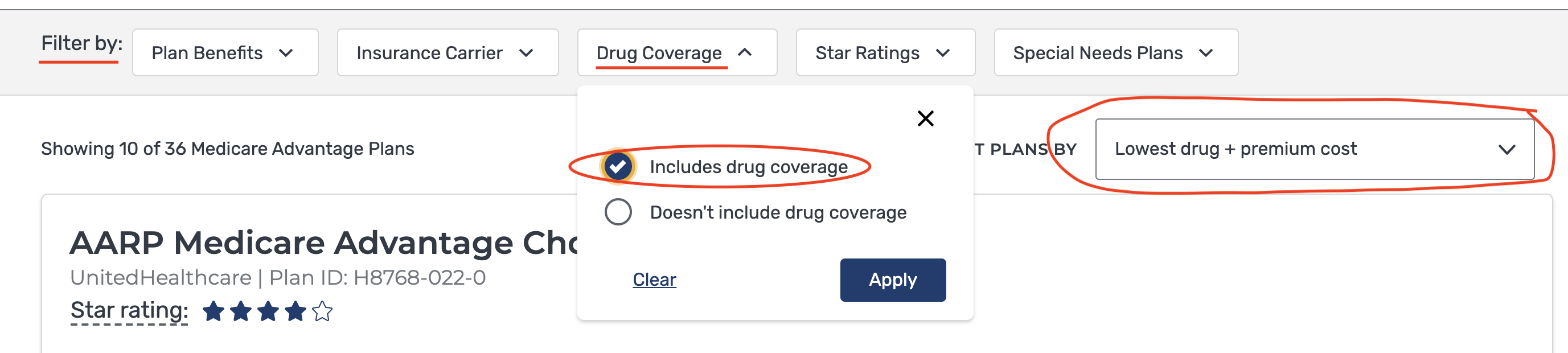

5) Once you’re done adding your pharmacies, you will land on a screen that lists all of the different plans that are available to you. You can choose to filter and sort the plans you are shown. Under “Filter by,” then “Drug Coverage,” choose “Includes drug coverage” as shown below. Then, directly underneath, sort plans by “Lowest drug + premium cost.” This ensures you’ll see the true total cost of the plan—what the premium (cost of the coverage) is and what your out-of-pocket costs for your medications will be.

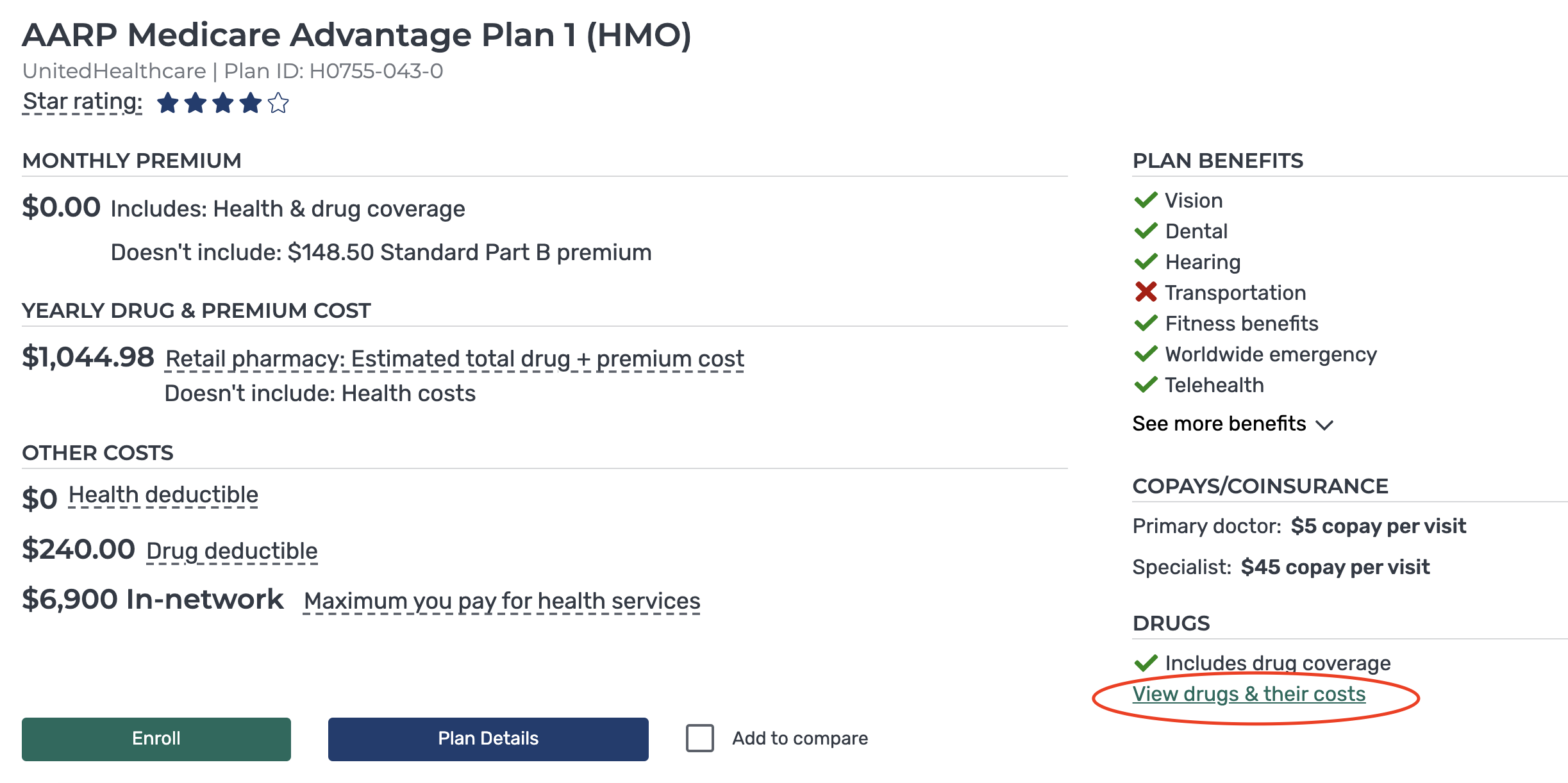

Pay attention to small notes under each of the plans, like if it says that the monthly premium is $0, but “Doesn’t include Standard Part B Premium.” All of these little details add up. Reminder: Medicare can be hard to navigate on your own, but shiphelp.org is a free, available-to-anyone service that offers localized, expert help in choosing all of the different aspects of a Medicare plan—including programs that may lower your out-of-pocket costs—that will be right for you.

6) When comparing each plan, click on “View drugs and their costs” to find out what your true out-of-pocket costs will be before and after your deductible. Your plans available will be different than the one shown below; this is just an example.

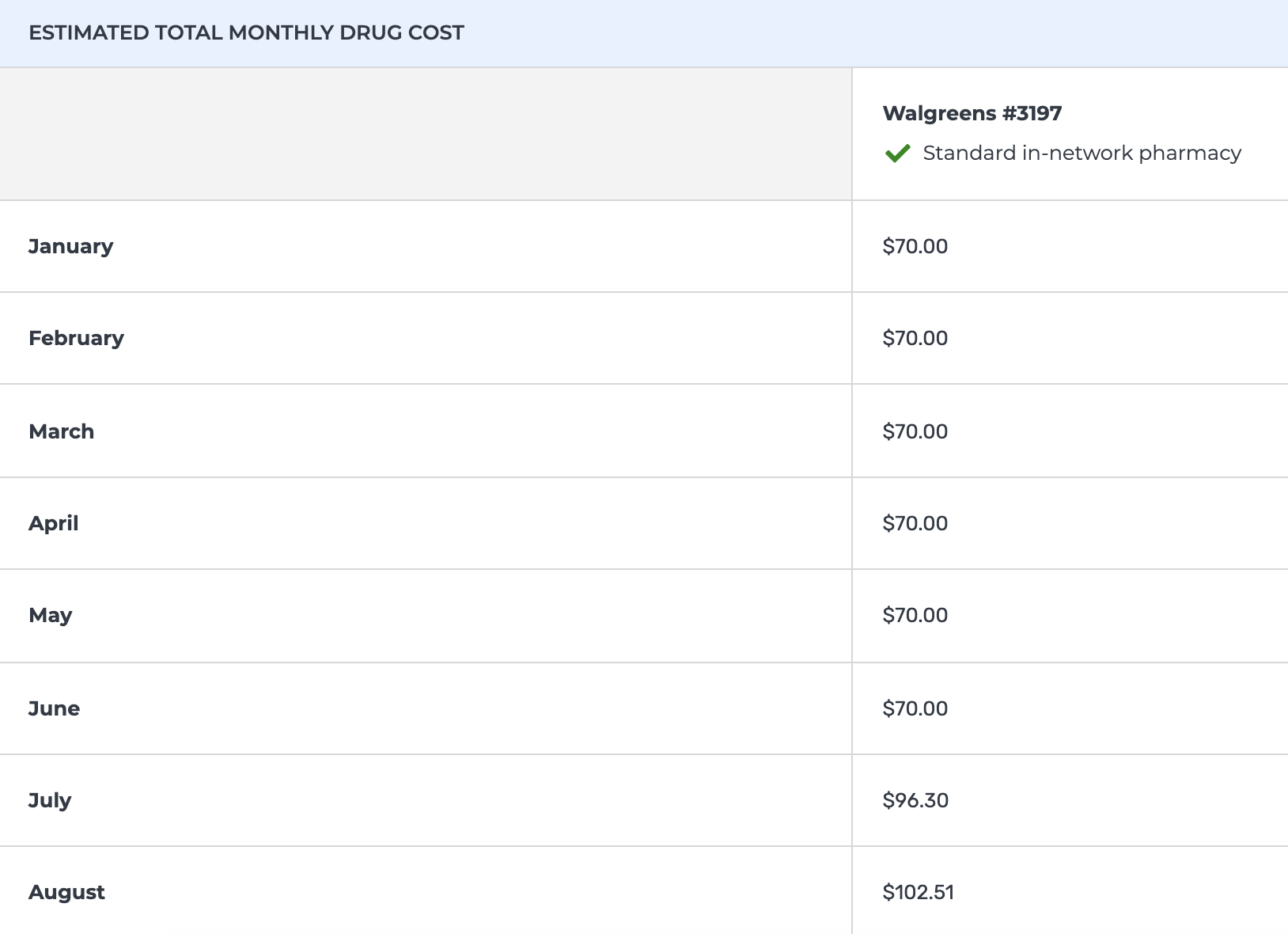

7) Once you click on “View drugs + their costs,” you will be taken to a screen that shows expected out-of-pocket costs based on the drugs you require, the pharmacy you use and the plan coverage. This page will list your monthly expected costs based on the medications you entered, including month-by-month cost expectations based on when you’ll enter the drug coverage gap and when you’ll get out of it. Note below that this can impact your monthly out-of-pocket costs significantly.

Remember as well that this comparison tool does not capture costs of regular medical needs that are not medications, like insulin pump or continuous glucose monitor supplies, blood sugar test strips, etc. The navigators at shiphelp.org can also help account for these additional costs in your plan options.

8) Once you’ve found a few plans that you think may work for your needs, you can click Add to Compare under any of the plans, then compare them to other options. Be sure to keep in mind that a plan with a low premium may not have ideal drug coverage, so may end up costing you more money over time than a plan with a higher premium but strong drug coverage.

8) Once you’ve found a few plans that you think may work for your needs, you can click Add to Compare under any of the plans, then compare them to other options. Be sure to keep in mind that a plan with a low premium may not have ideal drug coverage, so may end up costing you more money over time than a plan with a higher premium but strong drug coverage.

Overall, take time with this process. Important to note is that many people qualify for coverage under both Medicare and Medicaid, which offers more help with costs. To find out if you qualify, or for help with any and all Medicare questions, visit shiphelp.org. This free service offers localized, expert help in choosing all of the different aspects of a Medicare plan that will be right for you.